InsureMore

How Top Producers Use Automations To Earn More Commissions In Their Insurance Business

InsureMore

InsureMore

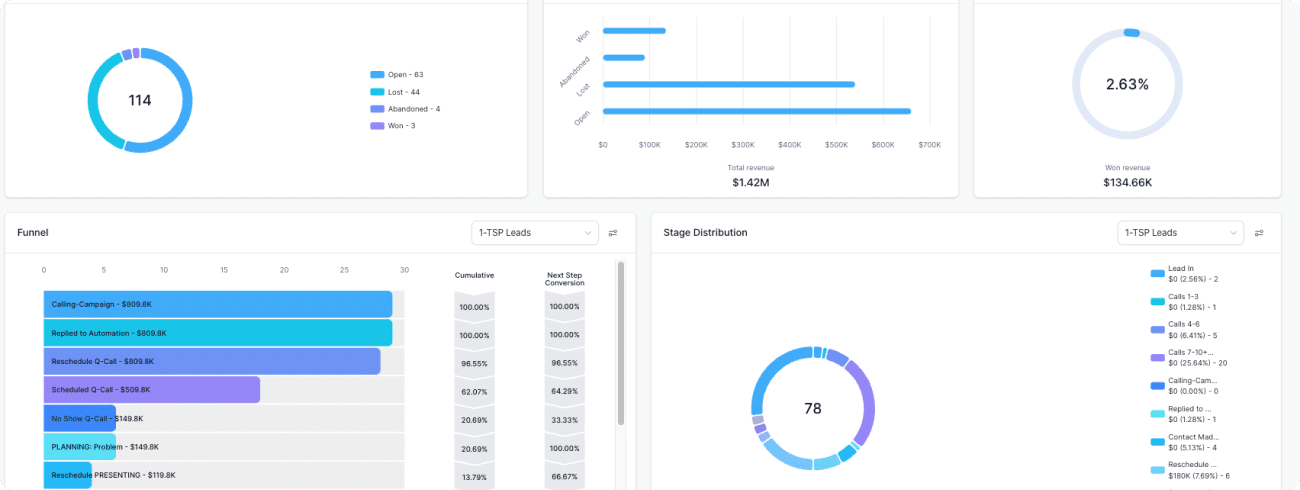

For most life insurance agents, their CRM is the backbone of their insurance business. If built and functioning properly – an automated insurance CRM will quietly drive your business forward and keep your pipeline flowing without a second thought.

However, through our experience working with over 1000 life insurance agents, we’ve identified that most CRMs are missing critical features and loaded with bugs that distract from an agent’s success rather than helping them make progress.

In response, we developed InsureMore, our proprietary CRM designed to supercharge your growth.

Built on years of research and testing, InsureMore CRM has propelled our clients to over $39 Million in tracked commissions.

InsureMore CRM is a profit-driving machine built for life agents. We developed this software on over a decade of experience closing millions in business. With InsureMore, you get all the features and benefits that a top-producing agent would include if they could build their own CRM… because that’s exactly what happened!

Even if you choose not to use InsureMore CRM, we’re here to equip you with the facts you need to know about insurance CRMs and automations.

As you read this page, we’ll dive into the key features you should look for in an insurance CRM, offering actionable insights to increase profits and efficiency, allowing you to focus on what truly matters.

The Big Question… Why Are Most CRMs So Bad?

This is surprisingly easy to answer…

Most CRMs underdeliver for life insurance agents and advisors because they’re not built and maintained by the people who use them.

These days, nearly anyone can white label a generic CRM and market it as an “Insurance CRM” even though it fails to tick nearly every box an active agent would be looking for…

But even if the CRM is well built; markets, needs and desires are moving along at a record pace. That means someone has to be constantly on top of maintaining and updating the software and features of your CRM if it will ever compete in the modern market.

And lastly, a counterintuitive reason why most CRMs flat-out fail is because they automate too much of the process.

Your prospects will catch on if a “robot” is doing too much of the selling and nurturing… so you need to find a middle ground between wasting too much time on tedious tasks and automating too much of your process. We call that a hybrid approach.

Why Top Producers Leverage Hybrid Automations

A master of their craft always knows the truth lies somewhere in the middle… The same applies to Top Producers who are pros at turning cold traffic into closed commissions.

They know you can’t automate the entire sales process down to an online form or chatbot that closes the deal…

But they also know that going old-school and completing the entire sales process manually is an outdated and ineffective strategy that wastes time and opportunities.

That’s why we and every other multi-million dollar producer we know go with a hybrid approach.

What’s that mean?

It means letting the CRM automate a portion of your follow-ups and knowing when it’s time to go hands-on to push the deal across the line with your intuition and hard-won skills.

No matter how sophisticated the automation, there’s no substitute for the personal touch of a trusted life insurance agent who genuinely cares about their client’s well-being and financial security. That’s where your expertise comes in.

While InsureMore CRM streamlines follow-ups, a successful agent will always recognize the importance of personal outreach to nurture client relationships.

These manual touch points include:

- Attending scheduled appointments

- Reviewing numbers and uncovering the prospect’s retirement goals

- Conducting follow-up calls to present tailored solutions

- Guiding leads through the application process to ensure smooth outcomes

- Replying to questions and offering advice

Besides fostering personal connections, manual follow-ups are crucial for another reason: timing.

Seizing moments when you’re available for a call can be game-changing. Often, reaching out during these windows results in meaningful connections, leading to successful deals.

While our Automations help take tedious tasks off your plate, they’re tailored to handle low-level activities.

The point is to free up your time and energy for high-impact, revenue-generating work like building trust, presenting cases, providing expert advice, and closing deals.

Automated workflows offer a convenient solution to handle repetitive, tedious tasks and streamline essential follow-up processes, freeing up your time for the tasks that require your expertise.

Here are some examples of when Automations come in clutch:

Engagement and Lead Management: Capturing and maintaining a lead’s interest from the start.

Appointment Scheduling: Seamlessly booking appointments without manual intervention.

Reminder Notifications: Send timely reminders to leads regarding upcoming appointments.

Nurture Campaigns: Implementing long-term nurture campaigns to keep leads engaged and informed.

What makes automations the real hero is their ability to keep moving deals through your pipeline even when you’re busy or off the clock.

This frees you up to achieve the holy grail of life insurance goals… a healthy work-life balance!

You can finally enjoy quality time with your family and pick up a hobby while your automated CRM handles the heavy lifting.

As we dive deeper, we’ll show you a better picture of how InsureMore CRM seamlessly integrates these automated workflows into your insurance business operations.

Automatic Appointment Booking

One of the most common complaints we hear from life agents is how hard it is to find exclusive leads who actually want to speak with you about solving their retirement income problems.

Most times, when you pay for leads, you’re getting a long list of recycled names who are going to let your call go to voicemail and never respond…

That’s what’s different about working with Jucebox. We guarantee your results. That means we refuse to deliver anything other than exclusive, high-intent leads who are problem aware and eager to hear how you can help them.

Here’s what that looks like:

- We offer your pick of an exclusive territory full of prospects ready to solve for more income when they retire.

- We build out a custom, done-for-you marketing campaign that grabs their attention, agitates their problem, builds trust in your solution and gets them to apply to work with you.

- Your pre-qualified leads are taken to a calendar scheduling page where they get to self-book an appointment directly on your calendar.

- InsureMore CRM takes the reins and keeps the prospect hooked from booking to closed deal. By barely lifting a finger of your own, we’ll keep the lead up to date and excited for their meeting with automated messages and alerts.

- All that’s left for you is hit “call” when it’s time to speak to your pre-booked and pre-qualified lead, leverage our proven sales scripts (to make things even easier) and watch the commission’s roll in.

OK, but you might be wondering, “what about the leads who aren’t quite ready to submit an application?”

Great question! No one wants to let an opportunity slip through the cracks… and we won’t!

Sometimes, pre-qualified leads go through your entire nurture sequence and don’t book. This can happen because they got distracted, lacked motivation or didn’t feel 100% convinced…

Whatever the reason – you’ll be in a great position to nurture and close that lead with our automated Lead-Aware follow up campaigns.

Through email and SMS text, these automated sequences will keep you top of mind with your prospect and move them into a position where they are desperate to get on your calendar.

You Want To Scale But Not Sure How

But What About The “No-Shows”?

No-shows are bound to happen to everyone. Prospects get busy, lose track of their schedule or sometimes lose interest…

When this happens, most CRMs leave you high and dry. They expect you to either get on the phone and invest your precious time trying to recapture that lead or take the loss and move on.

Neither of those are acceptable options. We’ve taken enough calls and been ghosted by enough prospects to know this is a major pain point for motivated life agents…

That’s why we built even more value into InsureMore CRM by including tailored automations that remind the prospect why they booked in the first place and keeps working, communicating trust and value to them until they book another call.

This entire process is intentionally designed to take the responsibility of following up off your shoulder so you can focus on high-leverage tasks like taking calls, building cases and nurturing relationships.

You Want To Scale But Not Sure How

You Want To Scale But Not Sure How

Booking appointments, managing your pipeline & following up with prospects are all critical steps in your sales process. InsureMore CRM helps with all that!

But it also helps free up your time, relieve your stress and close more deals with these features:

Calendars

Sync your calendar with other devices and applications, ensuring you never miss an important meeting or follow-up.

Customize your calendar view to prioritize tasks, appointments, and deadlines, allowing you to focus on what matters most. Whether juggling multiple leads or balancing personal and professional commitments, our calendar management features will streamline your scheduling process and improve your productivity.

Follow-Up Campaigns

Design custom email sequences, drip campaigns, and outreach strategies to deliver valuable content and offers to your audience. Segment your leads based on demographics, behavior, and preferences, allowing you to deliver personalized messaging that resonates with each recipient.

Track the performance of your campaigns in real time, monitoring open rates, click-through rates, and conversion metrics to optimize your approach.

Relationship Management

InsureMore CRM includes robust relationship management features, allowing you to track interactions, preferences, and important details about each lead to foster stronger connections.

Customer data is easy to access with our centralized database and provides a comprehensive view of each client relationship. Capture notes, emails, phone calls, and meetings directly within the CRM, ensuring convenient access when you need it on the fly.

Appointment Management

Effortlessly monitor, schedule and manage appointments, track availability, and coordinate with leads to streamline the sales process.

Set up automated reminders and notifications to minimize no-shows and ensure everyone is prepared for their appointments.

Customize appointment settings, including duration, location, and agenda, to meet the unique needs of each client interaction. Whether you’re conducting virtual meetings or meeting in person, our appointment management features will help you stay organized, punctual, and professional at every step of the process.

Scheduling

Our scheduling tools make it easy to book appointments, manage availability, and avoid scheduling conflicts, streamlining the process for both you and your leads.

Sync your calendar with other scheduling tools and applications, ensuring consistency and accuracy across all platforms.

Set up automated reminders and confirmations to minimize missed appointments and maximize show up rates.

Social Media Planner

Plan and schedule your social media posts directly from the CRM, allowing you to maintain a consistent online presence and engage with your audience effectively.

Create and schedule posts across multiple social media platforms, including Facebook, Twitter, LinkedIn, and Instagram, from a single dashboard.

Customize your posting schedule and frequency to align with your marketing strategy and audience preferences.

Monitor engagement metrics and track performance in real-time, gaining valuable insights into your social media efforts and identifying opportunities for improvement.

Email Marketing

Nurture new leads, follow-up with current leads and maintain relationships with closed leads through targeted email marketing campaigns directly from InsureMore CRM. With customizable templates, automation options, and detailed analytics to optimize your strategy.

Win More Business With InsureMore CRM

When you put our InsureMore CRM to work for your business, commissions start rolling in (nearly) on autopilot.

It’s the easiest way to attract & nurture leads, maintain opportunities, close more deals and infinitely grow your business!

Let InsureMore handle the day-to-day while you focus on high-leverage opportunities (and maybe kicking your feet up a little more 😉)