How To Find The Best Insurance CRM For Your Business

- Jim Fisher

- Insurance CRM

Table Of Contents

- How to find the best insurance CRM

- The essentials of choosing an insurance CRM

- User friendly interface

- Customization

- Integration

- Automation

- Security

- Customer support

- Leading insurance CRMs in 2024

- How does an insurance CRM help you grow

- FAQs

- Connect with the Author

- Recommended posts

Are you an insurance agent who’s overwhelmed juggling client information, managing follow-ups, and keeping track of leads? You’re not alone!

Many insurance agents struggle to stay organized and efficient in this fast-paced industry. They need a tool that can streamline their workflows, automate their follow-ups and give them a huge edge over their competition.

And there’s no better tool to help them accomplish those goals and grow their business than a robust and easy-to-use CRM for insurance agents.

In this article, we’ll explore how to find the best Insurance CRM for your business. From understanding the essential features to knowing the leading options in the market, you’ll get a comprehensive guide to make an informed decision.

Studies show that businesses using a CRM can increase sales by up to 29% and improve productivity by 34% (source: Salesforce) – with that in mind – let’s dive in!

Key Takeaways

Key Takeaways

Choosing the right insurance CRM can revolutionize your business by centralizing customer data, automating tasks, and enhancing customer relationships.

The best CRMs for insurance agents offer features tailored to the unique needs of the insurance market, such as policy management, client communication tracking, automated follow-up campaigns and lead generation tools.

The Essentials of Choosing An Insurance CRM

The Essentials of Choosing An Insurance CRM

When selecting an insurance CRM, it’s crucial to look for features that address the specific challenges of the insurance industry. Here are some key considerations:

User-Friendly Interface:

The CRM should be easy to navigate, ensuring you and your team can quickly adopt and utilize the system.

An intuitive interface reduces the learning curve and increases productivity from day one. A well-designed user interface minimizes the need for extensive training and allows agents to focus on their core tasks without getting bogged down by complicated software.

Customization:

Look for a CRM that allows customization to fit your unique business processes and workflows. The ability to tailor the CRM to your specific needs ensures that you can maximize its effectiveness.

Look for customizable fields, dashboards, and reporting tools that prove the CRM can adapt as your business evolves, ensuring it remains valuable and efficient as your business grows.

Integration:

Ensure the CRM can integrate with other essential tools in your process such as email, marketing software, social media platforms and insurance quoting systems.

Seamless integration with your existing and future assets will boost efficiency and increase your data accuracy.

By connecting your CRM with other applications, you can automate data transfers and streamline your workflow, reducing the risk of errors and saving time on manual data entry.

Automation:

Automating repetitive tasks like follow-ups, appointment scheduling and reminders will save time and reduce errors.

Ensure your insurance CRM has features like automated email campaigns, task reminders, and workflow automation.

Automation can significantly enhance productivity by handling routine tasks, allowing agents to focus on more strategic activities, such as building client relationships and closing deals.

Security

Given the sensitive nature of insurance data, robust security features are a must. Ensure the CRM offers encryption, regular backups, and compliance with industry standards.

Protecting client data from breaches and ensuring compliance with regulations like GDPR and HIPAA are critical for maintaining trust and avoiding costly penalties.

Customer Support:

Reliable customer support can help you resolve issues quickly and make the most out of your CRM. Check for available support channels and responsiveness.

Access to knowledgeable and responsive support can make a significant difference in ensuring your CRM runs smoothly and any issues are promptly addressed, minimizing downtime and disruption to your business.

Who Are The Leading Insurance CRMs in 2024?

Who Are The Leading Insurance CRMs in 2024?

AgencyBloc

Agents appreciate AgencyBloc’s comprehensive suite of features specifically designed for life and health insurance agencies.

Their platform offers robust tools and a user-friendly interface with customizable workflows designed to enhance productivity from the start.

Key Features:

- Advanced Reporting and Analytics

- Reliable Customer Support

- Commissions Processing

- Marketing Automation

- User-Friendly

Price:

Starts at $70/month.

RadiusBob

RadiusBob offers a versatile and affordable CRM solution specifically designed for the needs of health and life insurance agencies.

This CRM for insurance agents simplifies the sales process by providing an all-in-one platform to manage leads, clients, and quotes.

Key Features:

- Lead Management

- Software Integration

- Pipeline Management

- Reporting and Analytics

- Customizable Workflows

Price:

Starts at $34/month.

NowCerts

NowCerts features a powerful and user-friendly CRM tailored specifically to the needs of independent insurance agencies.

It streamlines the management of policies, automates workflows, and provides powerful reporting and analytics, which helps agents stay organized and efficient.

Key Features:

- Policy Management

- Automated Workflows

- Reporting and Analytics

- Intuitive Client Portal

- User-Friendly Interface

Price:

Starts at $75/month.

ZOHO CRM

Zoho CRM’s comprehensive suite of tools is designed to streamline sales processes, manage customer relationships, and enhance productivity.

Its user-friendly interface and customizable options allow insurance agents to tailor the system to their specific needs, ensuring they can effectively track leads, automate workflows, and gain insights through advanced analytics.

Key Features:

- Lead Management

- Omnichannel Marketing

- Intuitive UX

- Advanced Analytics

- Workflow Automation

Price:

Free – $52/month

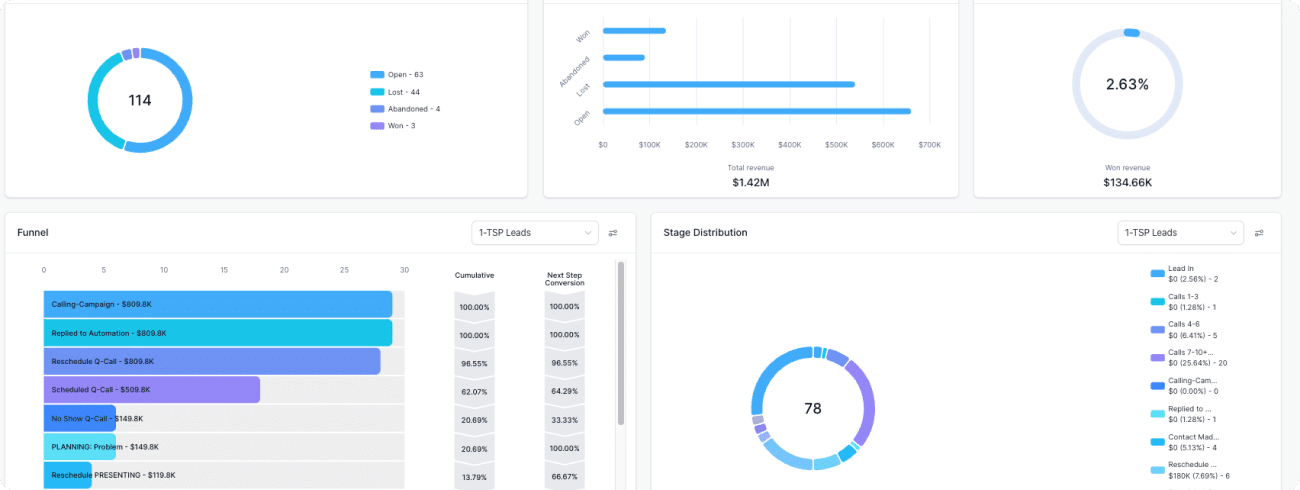

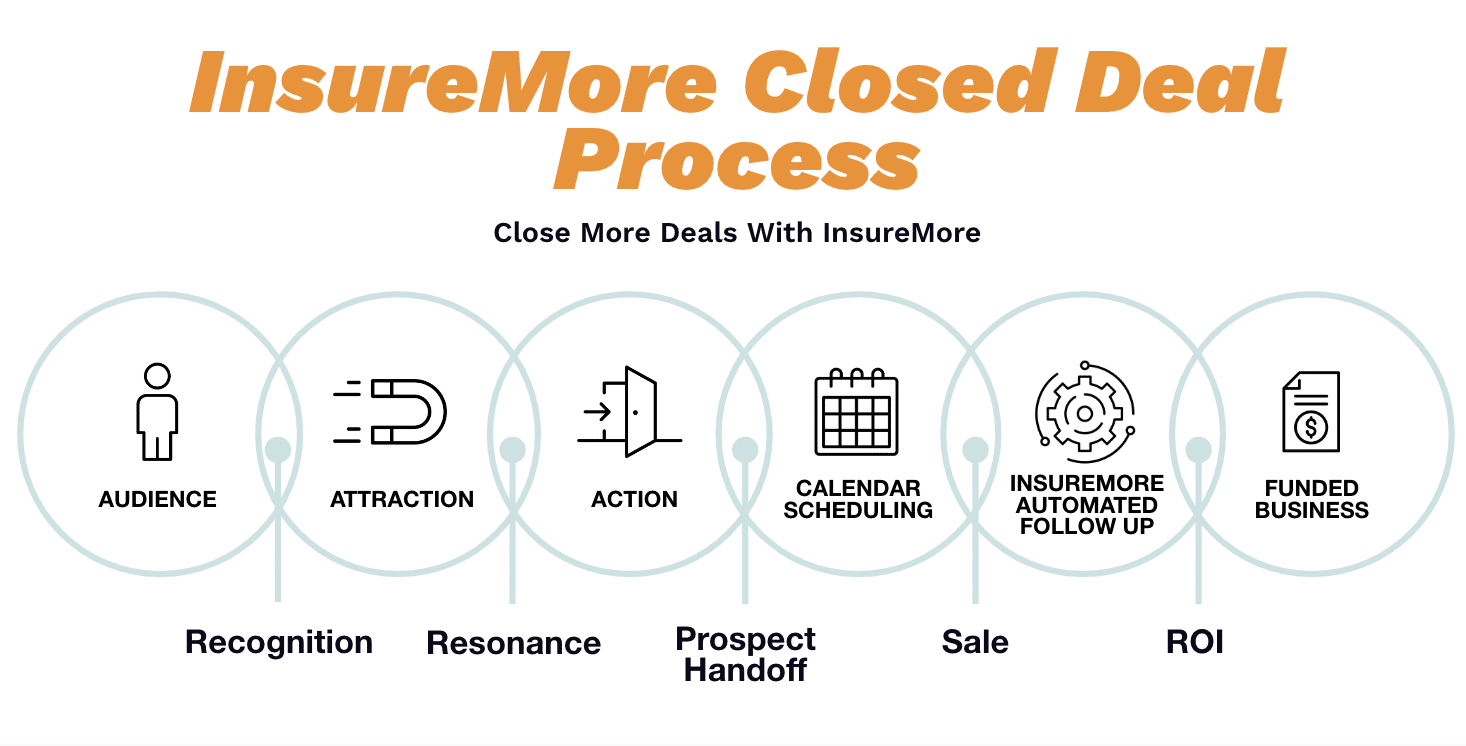

How InsureMore CRM Helps Insurance Agents Close More Business:

InsureMore CRM is thoughtfully designed and custom-built for insurance agents by top-producing life agents.

From booking appointments to managing your pipeline to tracking commissions & following up with prospects, the InsureMore CRM helps with all that and more:

Calendars:

Calendars:

With integrated calendars, you can easily schedule appointments, set reminders, and manage your time efficiently, helping you stay organized and on top of your schedule.

Sync your calendar with other devices and applications, ensuring you never miss an important meeting or follow-up.

Customize your calendar view to prioritize tasks, appointments, and deadlines, allowing you to focus on what matters most.

Whether juggling multiple leads or balancing personal and professional commitments, our calendar management features will streamline your scheduling process and improve your productivity.

Follow-Up Campaigns:

Follow-Up Campaigns:

Create and execute targeted follow-up campaigns or leverage our already built automations tailored to different segments of your leads to nurture relationships and win more business.

Design custom email sequences, drip campaigns, and outreach strategies to deliver valuable content and offers to your audience. Segment your leads based on demographics, behavior, and preferences, allowing you to deliver personalized messaging that resonates with each recipient.

Track the performance of your campaigns in real-time, monitoring open rates, click-through rates, and conversion metrics to optimize your approach.

Relationship Management:

Relationship Management:

InsureMore CRM includes robust relationship management features, allowing you to track interactions, preferences, and important details about each lead to foster stronger connections.

Customer data is easy to access with our centralized database and provides a comprehensive view of each client relationship. Capture notes, emails, phone calls, and meetings directly within the CRM, ensuring convenient access when you need it on the fly.

Appointment Management:

Appointment Management:

Effortlessly monitor, schedule and manage appointments, track availability, and coordinate with leads to streamline the sales process.

Set up automated reminders and notifications to minimize no-shows and ensure everyone is prepared for their appointments.

Customize appointment settings, including duration, location, and agenda, to meet the unique needs of each client interaction. Whether you’re conducting virtual meetings or meeting in person, our appointment management features will help you stay organized, punctual, and professional at every step of the process.

Scheduling:

Scheduling:

Our scheduling tools make it easy to book appointments, manage availability, and avoid scheduling conflicts, streamlining the process for both you and your leads.

Sync your calendar with other scheduling tools and applications, ensuring consistency and accuracy across all platforms.

Set up automated reminders and confirmations to minimize missed appointments and maximize show up rates.

Social Media Planner:

Social Media Planner:

Plan and schedule your social media posts directly from the CRM, allowing you to maintain a consistent online presence and engage with your audience effectively.

Create and schedule posts across multiple social media platforms, including Facebook, Twitter, LinkedIn, and Instagram, from a single dashboard.

Customize your posting schedule and frequency to align with your marketing strategy and audience preferences.

Monitor engagement metrics and track performance in real-time, gaining valuable insights into your social media efforts and identifying opportunities for improvement.

Email Marketing:

Email Marketing:

Nurture new leads, follow-up with current leads and maintain relationships with closed leads through targeted email marketing campaigns directly from InsureMore CRM. With customizable templates, automation options, and detailed analytics to optimize your strategy.

How Does Incorporating a CRM into Your Insurance Business Help You Grow?

How Does Incorporating a CRM into Your Insurance Business Help You Grow?

Incorporating a CRM into your insurance business can transform the way you operate, providing a range of benefits that streamline processes, increase productivity and close more business.

An effective insurance CRM not only centralizes client information but also automates routine tasks, allowing you to focus on building relationships and closing deals. By leveraging the power of a CRM, insurance agents can significantly improve their efficiency, organization, and overall business performance.

Let’s look into some key benefits of integrating a CRM into your insurance business.

Improved Organization:

Centralize all client information and interactions in one place, making it easier to manage and access data. This reduces the risk of data loss and enhances data accuracy.

Enhanced Customer Service:

Quickly respond to client inquiries and stay on top of policy renewals and follow-ups. With a CRM, you can track every interaction and ensure timely communication.

Increased Efficiency:

Automate repetitive tasks, allowing you to focus on more strategic activities. Automation can significantly reduce administrative burdens and free up time for client-facing activities.

Better Lead Management:

Track and nurture leads effectively, increasing the chances of conversion. A CRM helps you prioritize leads based on their likelihood to convert, ensuring you focus your efforts where they matter most.

Data-Driven Insights:

Utilize reports and analytics to make informed decisions and improve business strategies. Access to real-time data and performance metrics enables you to identify trends and opportunities.

Scalability:

As your business grows, a good CRM can scale with you, accommodating more clients and complex workflows. This ensures that your CRM continues to meet your needs as your business grows.

Frequently Asked Questions

An insurance CRM is a customer relationship management system specifically designed to meet the needs of insurance agents and agencies. It helps manage client interactions, policies, and sales processes.

It helps streamline your workflow, improve customer service, and manage client information and interactions more effectively. By centralizing data and automating tasks, a CRM enhances efficiency and productivity.

Yes, most insurance CRMs offer integrations with email platforms, marketing tools, and quoting systems. Integration ensures seamless data flow and reduces the need for manual data entry.

Reputable CRMs offer robust security features to protect sensitive client information. Look for features such as encryption, regular backups, and compliance with industry standards.

Prices vary depending on the features and scale of the CRM. Basic plans can start as low as $34/month, while more comprehensive solutions can cost upwards of $75/month or more.

Most CRMs offer customer support through various channels, including email, phone, and live chat. Additionally, many providers offer extensive knowledge bases and online resources to help you get the most out of your CRM.

Win More Business with the Right CRM

Win More Business with the Right CRM

Finding the right Insurance CRM can transform your business, making it more efficient, organized, and profitable. By focusing on essential features and exploring leading options like InsureMore CRM, you can choose a solution that best fits your needs.

Ready to take your insurance business to the next level? Book a call with Jucebox to learn more about how our coaching, mentorship, exclusive leads, and free access to InsureMore CRM can help you close more business effortlessly.

Jim Fisher

Jim is an award-winning marketer and licensed producer. He has helped over 1000 agents and advisors scale their life and annuity production to become top 1% producers.

More from the blog

Annuity Sales Scripts (Leaked Coaching Call)

If you’re tired of hearing “I’ll think about it” from

Best Life Insurance Sales Training Programs

Best Life Insurance Sales Training Programs Table Of Contents Introduction: