What Is An Annuity Lead Source

And Why Is It Important?

- Jim Fisher

- Annuity Related

Table Of Contents

- What is an annuity lead source?

- What are lead sources?

- Types of lead sources

- What should you look for in an annuity lead source?

- Qualified and educated

- Timely

- The big secret

- Silver bullets

- Boost your lead generation today

- Connect with the Author

- Recommended posts

What Are Lead Sources and How Do They Work?

What Are Lead Sources and How Do They Work?

Lead sources are methods or platforms where potential customers (leads) are identified and acquired. They are the lifeblood of any sales-driven business, providing a steady stream of prospects to nurture and convert into clients. Effective lead sources can vary widely depending on the industry, target audience, and marketing strategies that are used.

They work by capturing the attention of potential customers and encouraging them to express interest in your products or services.

This can be achieved through online advertising, social media campaigns, direct mail, telemarketing, and even events. Once a lead shows interest, their information is collected and passed on to the sales team for follow-up and conversion.

The process typically involves several stages:

- Attracting potential leads

- Capturing their information

- Nurturing them through targeted communication

- Converting them into paying customers.

The quality of the leads will play a crucial role in your success because high-quality leads are more likely to result in closed business.

Effective lead sources not only generate a high volume of leads but also ensure that these leads are well-qualified and likely to convert. This requires a strategic approach to marketing and lead generation, leveraging data and analytics to identify and target the right prospects.

Types of Lead Sources

Types of Lead Sources

- Online Advertising: Platforms like Google Ads and social media ads target specific demographics and behaviors to attract potential leads. These ads can be highly effective due to their ability to reach a large and targeted audience quickly.

2. Online Advertising: Platforms like Google Ads and social media ads target specific demographics and behaviors to attract potential leads. These ads can be highly effective due to their ability to reach a large and targeted audience quickly.

3. Content Marketing: Creating valuable content like blogs, videos, and eBooks that address the needs and interests of your target audience can attract leads organically. This strategy builds trust and positions you as an authority in your field.

4. Referrals: Encouraging satisfied clients to refer friends and family can generate high-quality leads. Referral leads often come with a built-in level of trust and credibility, making them easier to convert.

5. Networking Events: Attending industry events, trade shows, and conferences can provide direct access to potential leads. Face-to-face interactions at these events can be particularly effective in building relationships and trust.

What Is A High-Quality Annuity Lead Source?

What Is A High-Quality Annuity Lead Source?

A high-quality annuity lead source will specifically target prospects interested in purchasing annuities. This can occur on various platforms, but here are three key factors to consider when looking for an annuity lead source:

Exclusivity

One of the most critical aspects of a quality annuity lead source is exclusivity. Non-exclusive leads mean you’re competing against multiple advisors for the same prospect, which can dilute your efforts and reduce conversion rates.

Exclusive leads, on the other hand, ensure that you are the only advisor contacting the prospect, increasing your chances of closing the sale. This approach is more sustainable and effective in the long run, allowing you to build a stronger rapport and trust with your prospects.

Qualified & Educated

For leads to be valuable, there needs to be alignment between what the prospect is looking for and what the agent offers.

Qualified and educated leads have shown genuine interest in annuities and have a basic understanding of what they are.

This alignment ensures that your conversations with prospects are more productive and that the leads are more likely to convert into clients.

Timeliness

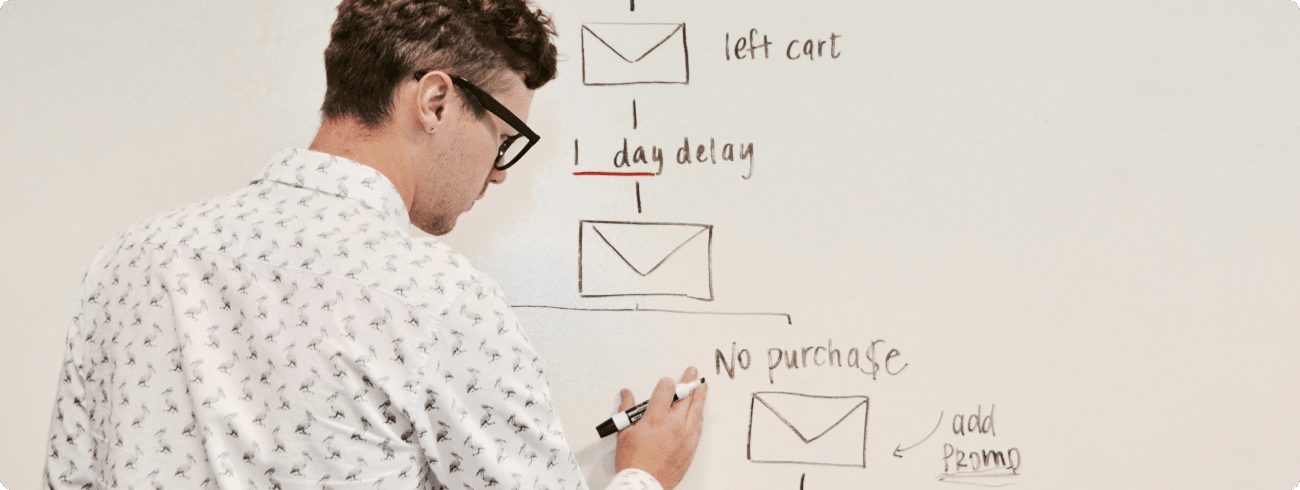

Speed matters when it comes to connecting with your leads. The sooner you reach out to a new lead, the higher the chance of conversion. Purchasing old leads or delaying follow-up can result in lost opportunities.

According to a study by Harvard Business Review, companies that contact leads within an hour are seven times more likely to have meaningful conversations with decision-makers than those who wait longer (source: HBR).

There is No ‘Best’ Annuity Lead

There is No ‘Best’ Annuity Lead

Even with well-educated, qualified, and timely leads, converting them still comes down to the skill and effort of the salesperson.

There will never be a lead that simply walks in and says, “I want a $1000 a month IUL with F&G and I need you to execute that on my behalf” without any sales effort.

Converting leads into clients requires a strategic sales process. This involves building rapport, uncovering your prospect’s needs, and effectively communicating the exact way your product solves for their problems.

If You’re Looking for a Silver Bullet Lead, You Won’t Find It

If You’re Looking for a Silver Bullet Lead, You Won’t Find It

Many agents fall into the trap of searching for the perfect leads that will effortlessly convert into sales. Unfortunately, bad actors have set those agents up for disappointment by promising them “silver bullet leads.” However, this is the reality…

There is no one lead source that can guarantee conversions without effort from the salesperson. If a silver bullet lead existed, insurance companies wouldn’t need agents. So for now (and always) a successful sales process will require persistence, skill, and continuous improvement.

As the saying goes:

“There is no silver bullet. There are always options and the options have consequences.” – Ben Horowitz

It’s up to the agent to choose the best lead source options that will result in the best consequences!

Mastering Annuity Leads for Business Growth

Mastering Annuity Leads for Business Growth

Understanding and leveraging high-quality annuity lead sources can significantly improve your success as an insurance agent.

By focusing on acquiring exclusive, qualified, and timely leads, and recognizing that there is no silver bullet, you can develop a powerful and effective strategy for converting prospects into clients.

And remember, the key to success lies in your ability to nurture and convert leads through a strategic and proven sales process

Want help acquiring done-for-you exclusive leads and developing your ability to close more business with coaching from top 1% life and annuity producers? Learn more about how we help life agents level up their business by Booking a call to speak with our team >

Jim Fisher

Jim is an award-winning marketer and licensed producer. He has helped over 1000 agents and advisors scale their life and annuity production to become top 1% producers.

More from the blog

Annuity Sales Scripts (Leaked Coaching Call)

If you’re tired of hearing “I’ll think about it” from

Best Life Insurance Sales Training Programs

Best Life Insurance Sales Training Programs Table Of Contents Introduction: